La crisi d’impresa rappresenta una condizione in cui un’azienda non è più in grado di raggiungere i suoi obiettivi fondamentali, a causa di perdite economiche significative che compromettono sia la redditività che il valore complessivo dell’impresa. Questo stato di crisi, che rende probabile l’insolvenza del debitore, si manifesta quando i flussi di cassa futuri dell’impresa non sono sufficienti a coprire regolarmente le obbligazioni finanziarie nei 12 mesi successivi. La crisi influisce negativamente sulla stabilità finanziaria dell’azienda, minacciando la sua capacità di operare in modo continuo e, se non affrontata adeguatamente, può condurre all’insolvenza.

Le cause della crisi aziendale possono essere di natura esogena e/o endogena. Le imprese, e in particolare le PMI, sono risultano particolarmente vulnerabili alle cause esogene, che includono significative variazioni nella domanda e del costo degli approvigionamenti legate a eventi esterni come la recente pandemia, la crisi energetica e l’aumento dei costi delle materie prime, derivanti dai conflitti geopolitici in atto. Questi fattori esterni possono esercitare pressioni notevoli, influenzando negativamente l’impresa nel mantenere la sua competitività e stabilità finanziaria, e portando a difficoltà nel soddisfare le esigenze operative e di mercato.

Le cause interne, o endogene, della crisi d’impresa sono altredì di complessa gestione, e sono legate a fattori che emergono direttamente dalla gestione e dalle operazioni aziendali. Da una scarsa pianificazione e un’errata valutazione delle opportunità di mercato, alla mancanza di innovazione e la resistenza al cambiamento che possono limitare la competitività e l’efficienza operativa dell’impresa. Inoltre, una gestione finanziaria inefficace può provocare una non congrua allocazione delle risorse e la difficoltà nel mantenere una liquidità adeguata, aggravando la sostenibilità dell’impresa.

Nel contesto attuale, segnato dalle difficoltà socio-economiche degli ultimi quattro anni, come la pandemia e il conflitto Russo-Ucraino, i fallimenti delle imprese italiane hanno mostrato un incremento nel secondo trimestre del 2023. Secondo l’Osservatorio Fallimenti Cerved, i fallimenti sono aumentati del 1,5%, raggiungendo un totale di 2.070 casi, mentre le liquidazioni volontarie sono aumentate del 26,1%, arrivando a 10.446. Questi fallimenti hanno avuto un impatto predominante sul settore industriale, con una concentrazione maggiore nel Centro e nel Nord-Est Italia e con un’incidenza significativa sulle PMI. I settori meno colpiti sono stati quelli dell’elettrotecnica, dell’informatica, della chimica e della farmaceutica, oltre agli operatori logistici. Si osserva una dinamica interessante nel settore delle costruzioni: a fronte dell’ormai imminente conclusione del periodo di incentivi, il numero di fallimenti è diminuito rispetto al 2022, mentre si è registrata una notevole crescita delle liquidazioni volontarie.

La nuova normativa – “Prevenire è meglio che curare”

Il Codice di Crisi di Impresa e di Insolvenza, entrato in vigore il 15 luglio 2022, offre un approccio riformato e integrato per affrontare le crisi aziendali nell’attuale contesto, con un’enfasi sulla prevenzione e sull’intervento tempestivo per evitare il deterioramento delle condizioni finanziarie delle imprese. Questo codice ha unificato la normativa relativa alla gestione delle crisi aziendali in un unico corpo legislativo, fatta eccezione per le grandi imprese, che continueranno a essere regolate dalla procedura di amministrazione straordinaria. Il percorso verso l’insolvenza non è immediato, ma è caratterizzato da segnali progressivi di declino; senza interventi correttivi tempestivi, questi segnali possono evolvere in una crisi profonda, caratterizzata da persistenti difficoltà finanziarie e un’ulteriore erosione delle performance aziendali.

Come in ambito sanitario, prevenire è meglio che curare – la nuova normativa mira ad identificare e correggere tempestivamente le criticità negli assetti organizzativi, amministrativi e contabili per preservare la sostenibilità dell’impresa.

Art. 3 – Codice di Crisi d’Impresa e dell’Insolvenza

1.“L’imprenditore individuale deve adottare misure idonee a rilevare tempestivamente lo stato di crisi e assumere senza indugio le iniziative necessarie a farvi fronte”

2.“L’imprenditore collettivo deve adottare un assetto organizzativo adeguato ai sensi dell’articolo 2086 del codice civile, ai fini della tempestiva rilevazione dello stato di crisi e dell’assunzione di idonee iniziative”

Oggi è più cruciale che mai disporre tempestivamente delle competenze e degli strumenti necessari per una valutazione prospettica della salute aziendale. È fondamentale concentrarsi sul monitoraggio dei flussi di cassa al fine di individuare precocemente potenziali squilibri finanziari, reddituali e patrimoniali. Un approccio analitico e preventivo non solo consente di prevenire situazioni critiche, ma facilita anche l’adozione di interventi correttivi mirati per garantire la stabilità e la sostenibilità a lungo termine dell’impresa.

A cura di:

Daniele Piazzalunga

Mattia Cattaneo

Overview of the European Packaging Industry

The packaging industry in Europe is a robust and dynamic sector, playing a crucial role in the region’s economy. It serves as a key enabler various industries, including food and beverages, pharmaceuticals, cosmetics, and consumer goods, and is characterized by notable diversity, ranging from traditional materials like paper and glass to advanced plastic packaging solutions.

In recent years, driven by increasing consumer awareness, stringent regulatory frameworks, and corporate social responsibility commitments, the European packaging industry has faced growing pressure to transition towards more sustainable practices. The European Union (EU) has been at the forefront of promoting sustainability, implementing policies, such as the Circular Economy Action Plan), aimed at encouraging recycling and waste reduction as one of the main building blocks of the European Green Deal, Europe’s new agenda for sustainable growth.

In this context, one of the greatest challenges confronting the packaging industry is the EU’s stringent stance on plastic packaging. Plastic, which has been a cornerstone of modern packaging due to its versatility, light weight, and low cost, is now under intense scrutiny due to its environmental impact. The widespread use of single-use plastics and the growing problem of plastic pollution in oceans and landfills have led to calls for a comprehensive ban or severe restrictions on plastic packaging. The potential impact of such measures on the packaging industry is profound, requiring a thorough examination of both challenges and opportunities.

Prospective Impact of the Plastic Ban

The European Union’s Directive on Single-use plastics marks a significant step towards reducing plastic waste. The directive aims to ban or restrict the use of certain plastic products, including plastic bags, straws, cutlery, and plates, by 2025.

The impact of this ban on the European packaging industry is anticipated to be both significant and multifaceted. The following section explores and discusses four key trends that are expected to emerge.

- Downstream Supply Chain Impacts and Switching Costs for Manufacturers/Producers: The plastic ban presents significant challenges for manufacturers heavily reliant on plastic packaging. It could disrupt supply chains, increase production costs, and require substantial investment in research and development to identify viable alternatives. For instance, companies in the food packaging sector may need to transition from plastic to biodegradable or compostable materials, which are often more expensive and less versatile.

- Shifts in Market Dynamics: The plastic ban could also lead to a shift in market dynamics. Smaller packaging companies, which may lack the resources to quickly adapt to new materials, could find themselves at a disadvantage compared to larger firms with more robust R&D capabilities. In turn, this could drive market consolidation, as larger players acquire smaller companies to strengthen their position in the sustainable packaging market.

- Opportunities for innovation and growth: The plastic ban is expected to sharply increase the demand for alternative packaging materials, such as paper, glass, and bioplastics. As such, companies that can develop and scale up sustainable packaging solutions are likely to benefit from increased market share and consumer preference. For instance, the paper packaging segment, which is already well-established in Europe, could see significant growth as it offers a renewable and recyclable alternative to plastic.

Furthermore, the ban may stimulate the development of new technologies and business models. For example, one emerging trend is reusable packaging systems, where consumers return packaging for cleaning and reuse, reducing the reliance on single-use materials. This model aligns with circular economy principles and provides companies with opportunities to build stronger relationships with consumers through subscription or loyalty programs. - Stewardship beyond EU: The impact of the plastic ban is also likely to extend beyond Europe, influencing global packaging trends. European companies, which often set the standard for sustainability in packaging, may lead the way in exporting sustainable packaging technologies and practices to other regions. This could position Europe as a global leader in the sustainable packaging market, creating new export opportunities and driving economic growth.

Ultimately, the plastic ban is not to be seen as a mere regulatory challenge but as a catalyst for transformation within the packaging industry. While it poses significant challenges, including potential disruptions to supply chains and increased costs, it also offers substantial opportunities for innovation and growth, offering companies that can quickly adapt and proactively develop sustainable packaging solutions a competitive edge to thrive in the long term.

A cura di:

Fabio Trabucchi

Sebastian Birolini (Università degli Studi di Bergamo)

Il settore del venture capital (VC) si trova oggi in una fase di forte espansione. Nonostante la pandemia abbia colpito duramente pressoché l’intera economia globale ed impattato sulle dinamiche degli investimenti, il settore del venture capital ha saputo reagire repentinamente con una forte ripresa apartire dal secondo semestre del 2020, tale da portare il saldo annuale di Europa e Stati Uniti in positivo e superiore del 23% e 16% rispetto al 2019. Crescita che si è consolidata prepotentemente nel corso 2021, anno in cui il mercato globale del venture capital ha raggiunto livelli senza precedenti e si appresta a registrare il suo massimo storico.

Sulla base degli ultimi dati contenuti del report “Venture Pulse” di KPMG, il primo semestre dell’anno sppena trascorso è stato caratterizzato da un numero di deal superiore a 15.000, per un ammontare complessivo di investimenti in VC pari a 304,3 miliardi di dollari, in significativo aumento (+116%)rispetto a quanto registrato nel primo semestre dell’anno precedente. In termini geografici, l’Europa (60 miliardi di dollari) e gli Stati Uniti (150 miliardi di dollari) hanno raggiunto nuovi massimi storici per i volumi di finanziamento VC, riportando incrementi percentuali ben oltre il 100% rispetto ai valori semestrali pre-pandemia del 2019.

In termini settoriali, i maggiori investimenti nell’ultimo biennio sono stati rivolti principalmente ai settori che hanno beneficiato maggiormente della pandemia, come gaming, fintech, edtech, logistica e home delivery, assistenza sanitaria e biotecnologia. Tuttavia, è importante notare come questo fenomeno non sia da intendersi come mera risposta di breve periodo, ma piuttosto come manifestazione esacerbata ma coerente di un trend già in atto. Molti di questi settori -specie quelli a forte vocazione innovativa, quali software e biomedicale- risultano infatti già nel mirino degli investitori da diversi anni, come dimostrato dal progressivo aumento della rispettiva quota di rilevanza all’interno del portafoglio globale dei VC.

Il balzo in avanti del mercato VC conferma e irrobustisce la ripresa del settore, che appare oggi molto attivo, sostenuto da una quantità significativa di liquidità disponibile sul mercato e dalla necessità sempre maggior (quasi imprescindibile) di investire in business tecnologici e innovativi. In termini prospettici, questi driver sono destinate a durare, favorendo ulteriori sviluppi e crescita del settore del venture capital nei prossimi anni.

Anche in Italia il mercato è in forte accelerazione: dopo la ripresa e crescita degli investimenti in VC nel secondo semestre del 2020, che ha chiuso con investimenti nell’intorno di 378 milioni di Euro (+40% rispetto al 2019), le prospettive per il 2021 sono ancora più rosee. Secondo i dati Aifi e PwC, nel 2021 il venture capital potrebbe decollare, chiudendo oltre la soglia psicologica di un miliardo di Euro. I dati alla mano per il primo semestre supportano tali stime al rialzo, evidenziando come la raccolta complessiva sul mercato italiano del private equity e venture capital sia risultata pari a 2.827 milioni di Euro, registrando un significativo aumento del 194% rispetto ai primi sei mesi del 2020. La crescita del mercato italiano riduce il divario con i grandi partner europei dove il mercato è molto più sviluppato, non solo in termini di capitali movimentati ma anche in termini di operatori. Sempre secondo i dati raccolti da Aifi, la Francia ha registrato investimenti per oltre 2,1 miliardi di Euro nel 2020, la Germania per 1,9 miliardi e il Regno Unito per 1,8 miliardi di Euro. In termini di numero di operatori, l’Italia registra all’incirca 30 operatori, contro i 110 di Francia, 150 del Regno Unito e 160 della Germania, implicando un contributo maggioritario da parte di operatori esteri agli investimenti in VC in Italia. Ma il trend di crescita del mercato VC interno lascia certamente ben sperare e apre le porte a numerose opportunità di sviluppo.

Al netto di numerose e crescenti iniziative private, un forte segnale di sviluppo per il venture capital in Italia arriva dal settore pubblico con il recente Decreto Legge Infrastrutture che ha disposto che il MiSE potrà sottoscrivere fino a 2 miliardi in quote o azioni di fondi per il venture capital gestiti da Cdp Venture Capital Sgr. Tale iniziativa contribuirà al rafforzamento dell’ecosistema VC del Paese, non solo direttamente, ma anche indirettamente, attraendo un numero crescente di operatori privati. In aggiunta, dimostra una presa di coscienza circa l’importanza di supportare le giovani imprese, riconoscendo il fatto che sono proprio le realtà maggiormente tecnologiche ed impegnate sui nuovi filoni quelle che in futuro potranno diventare realtà di rilevanza nazionale e internazionale, in grado di generare occupazione e benessere diffuso.

A cura di:

Fabio Trabucchi

Sebastian Birolini (Università degli Studi di Bergamo)

Quanto accaduto a partire dai primi mesi del 2020 con l’emergenza Covid-19 e le conseguenti misure per il contenimento dei contagi ha portato con sé elementi di imprevedibilità e drammaticità tali da sconvolgere interi sistemi socioeconomici e modificare la percezione della realtà e del rischio ad essa associato da parte dei consumatori.

Tale emergenza ha contribuito ad un indebolimento del sistema produttivo del nostro Paese, provocando una importante contrazione delle performance economiche delle imprese in molteplici settori. Ponendo attenzione al settore manifatturiero, molteplici sono i trend che hanno determinato il nuovo contesto. Da un lato, le misure di lockdown hanno causato l’arresto marcato di grandi filiere, quali quelle del turismo e dei trasporti (es. comparto automotive); dall’altro, l’incremento nella seconda parte del 2020 del settore dell’edilizia, stimolato dagli incentivi promossi a livello governativo, congiuntamente all’incremento della spesa sanitaria legata al contrasto della pandemia e delle spese domestiche hanno in parte trainato la ripresa del sistema manifatturiero.

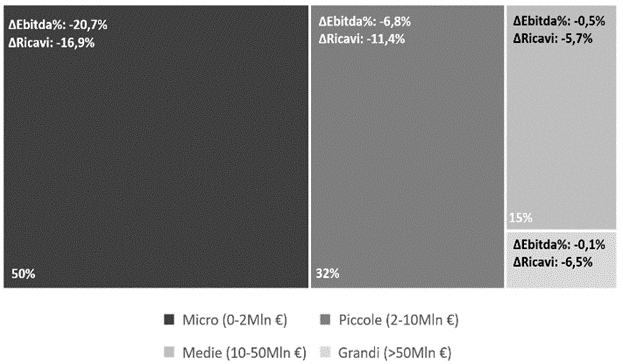

Analizzando i dati dell’intero comparto manifatturiero italiano*[1], si osserva un calo sia di fatturato che di redditività delle imprese italiane. Nel dettaglio, la pandemia ha provocato un cospicuo rallentamento del settore; a cavallo degli anni 2019 e 2020 si è registrato un decremento pari all’8,1% dei fatturati medi e di circa il 13% della marginalità operativa media (EBITDA margin). Come evidenziato in figura, le piccole imprese (categorie micro e small) hanno registrato la maggiore contrazione: un decremento dei ricavi medi nei due anni pari rispettivamente al -16,9% per le microimprese (>2Mln di fatturato) e del -11,4% per le piccole imprese (2-10 Mln di fatturato). Ancor più marcato è stato il rallentamento della marginalità operativa, pari al -20,7% nel caso delle microimprese (passando da una marginalità media del 9,4% al 7,5%). La battuta di arresto è risultata più contenuta per le medie-grandi imprese. Le prime hanno registrato una contrazione dei fatturati medi pari al -5,7%, mentre le seconde del -6,5%. In termini di marginalità, la pandemia ne ha arrestato l’incremento, senza tuttavia peggiorarne le performance significativamente.

Focalizzando l’analisi sul contesto regionale lombardo (che rappresenta circa il 30% delle imprese afferenti all’intero comparto manifatturiero italiano), le imprese hanno registrato un decremento pari al 9% dei ricavi e di circa 11% della marginalità. Nel dettaglio, le province che hanno registrano la maggiore contrazione in termine di ricavi medi sono Varese (-9,6%), Lecco (-10,8%) e Como (-14,8%). Le imprese manifatturiere presso la provincia di Como hanno registrato nel contempo anche la più grave contrazione in termine di marginalità media nei due anni (-26%), seguite da coloro che sono localizzate nel contesto pavese e milanese. Al contrario, le imprese che hanno evidenziato una contrazione meno marcata sia in termini di ricavi che di marginalità sono Mantova, Lodi e Sondrio. Significativa, anche in questo caso, è la differenza nelle performance tra micro-piccole imprese e medie-grandi imprese.

Cruciale per la ripresa del settore manifatturiero sarà l’andamento dei costi delle materie prime. L’incremento vertiginoso che ha contraddistinto i prezzi di molteplici commodities fa da contraltare alla ripresa del settore industriale avviata nel corso del 2021. L’importante disequilibrio generatosi tra domanda e offerta ha creato forti tensioni sul mercato. Valutando le quotazioni delle principali materie prime nella finestra temporale gennaio 2020-luglio 2021, l’Associazione Italiana Acquisti e Supply Management (ADACI) sottolinea come l’indice delle commodities industriali abbia segnato un +21% su scala europea. Una situazione complessa che ha assistito all’incremento sino al 100% dei prodotti chimici, e ancor più sostanziale quello dei coils laminati a caldo (+54% in UE). Forti rialzi hanno caratterizzato anche il prezzo delle commodities energetiche. In tali circostanze, il grado di resilienza delle organizzazioni, la capacità di sviluppare delle forme di adattamento e di cambiamento in grado di consentire una evoluzione delle attività, anche a fronte di condizioni di mercato instabili e mutevoli, rappresentano i temi più importanti per la ripartenza del tessuto industriale.

[1] Il campione è stato composto con aziende con codici ATECO afferenti al settore manifatturiero. Le elaborazioni hanno considerato le imprese con dati completi sulle dimensioni considerate.

A cura di:

Daniele Piazzalunga

Mattia Cattaneo (Università degli Studi di Bergamo)

La due diligence è un processo di audit fondamentale per l’acquisizione e la fusione di aziende, in cui si esaminano documenti finanziari, operativi e legali per valutare il valore e i rischi di un’impresa. Tuttavia, con l’adozione crescente dell’intelligenza artificiale (AI), il modo in cui questa pratica viene svolta sta cambiando rapidamente, rendendo il processo non solo più veloce ed efficiente, ma anche più preciso e informato.

L’impatto futuro dell’AI sulla due diligence nelle M&A

Nel 1770, l’inventore austriaco Wolfgang von Kempelen presentò il “Turco Meccanico“, una macchina da gioco a scacchi che sembrava giocare autonomamente contro avversari umani. Tuttavia, il segreto dietro questa macchina era semplice quanto ingannevole: sotto la macchina si trovava un uomo nascosto che manovrava i pezzi. Più di 250 anni dopo, un’altra invenzione ha affascinato il pubblico: grazie allo sviluppo di modelli linguistici di grandi dimensioni (LLM) come ChatGPT e Bard, l’AI generativa è diventata tangibile per un pubblico vasto e per molteplici settori aziendali. La questione rimane la medesima – Quali sono i meccanismi sottostanti e il valore aggiunto che ne deriva?

In ambito due diligence, come in molteplici altri settori in ambito economico-finanziario, l’intelligenza artificiale è risaputo avrà un ruolo sempre più centrale nell’ottimizzazione delle attività nel prossimo futuro. Grazie all’integrazione di tecnologie avanzate, come il machine learning (apprendimento automatico) e l’elaborazione del linguaggio naturale (NLP), i professionisti saranno in grado di analizzare enormi volumi di documenti e contratti con una velocità e una precisione mai raggiunte prima. L’AI non si limiterà a semplificare i flussi di lavoro, ma potrà anche aiutare a identificare potenziali problemi prima che diventino visibili, migliorando le decisioni prese durante i processi di M&A.

Il Ruolo dell’AI nella Due Diligence

Il principale vantaggio dell’intelligenza artificiale nella due diligence risiede nella capacità di analizzare grandi quantità di dati, identificando pattern e anomalie che potrebbero non essere immediatamente evidenti. Ciò è particolarmente utile per esaminare contratti complessi, documenti finanziari e altre informazioni critiche, riducendo i tempi e aumentando l’affidabilità.

Le fasi di due diligence e l’AI

- Fase di apertura: analisi delle informazioni e creazione di una Virtual Data Room

Quando l’acquirente inizia a esaminare la società target, l’AI può velocemente esplorare fonti pubbliche come comunicati stampa, dichiarazioni ufficiali e articoli di stampa per identificare potenziali dispute legali o fiscali. Inoltre, l’intelligenza artificiale consente di analizzare operazioni simili nel mercato, valutando precedenti transazioni e valorizzazioni per aiutare a fornire una stima più precisa del valore della target. Dal lato del venditore, l’AI ottimizza la creazione di una Virtual Data Room (VDR), organizzando automaticamente i documenti caricati e suggerendo eventuali cancellazioni di informazioni sensibili, migliorando l’efficienza e riducendo i rischi. - Fase intermedia: due diligence nella VDR

Una volta che la VDR è aperta per l’acquirente, l’AI svolge un ruolo fondamentale nel rilevare lacune nei documenti, confrontando i documenti caricati e segnalando in tempo reale le informazioni mancanti. Ad esempio, l’AI potrebbe identificare una transazione immobiliare in un bilancio annuale e verificare che tutta la documentazione necessaria sia correttamente inclusa, evidenziando in pochi secondi eventuali omissioni.

Apprendimento automatico e NLP nelle attività di due diligence

Le tecnologie di machine learning e elaborazione del linguaggio naturale sono particolarmente utili per la gestione dei dati non strutturati, come i contratti e le comunicazioni legali. Questi strumenti possono identificare automaticamente le clausole chiave e rilevare incoerenze o rischi nascosti che richiederebbero ore di analisi manuale. Inoltre, con l’evoluzione dei modelli di linguaggio come i Large Language Models, l’AI diventa sempre più capace di comprendere e sintetizzare linguaggio complesso, riducendo il rischio di errori umani e aumentando l’affidabilità del processo di due diligence.

I limiti e le sfide nell’uso dell’AI

Nonostante i numerosi vantaggi, l’uso dell’AI nella due diligence presenta ancora alcuni limiti rilevanti:

- Accessibilità e protezione dei dati: I dati nelle VDR sono altamente protetti e spesso il venditore non è disposto a condividere informazioni riservate per addestrare l’AI. Questo può limitare l’efficacia degli algoritmi durante le transazioni in corso.

- Affidabilità dei risultati: I modelli di AI, seppur avanzati, possono occasionalmente interpretare erroneamente i dati, un fenomeno noto come “allucinazione”. Questo rappresenta un rischio se ci si affida esclusivamente a questi strumenti per prendere decisioni.

- Conoscenza giuridica ed etica: La “corretta divulgazione” nei processi di M&A si basa ancora sulla capacità umana di interpretare le informazioni in modo contestuale. Sebbene l’AI possa aiutare a rilevare informazioni mancanti, la valutazione finale di ciò che è giuridicamente rilevante richiede ancora l’esperienza umana.

In sintesi, l’intelligenza artificiale ha il potenziale per rendere la due diligence nelle operazioni di M&A più efficiente, veloce e accurata, grazie alla capacità di analizzare grandi volumi di dati, identificare rischi nascosti e automatizzare compiti a basso valore aggiunto. Questo consente di ottimizzare tempi e risorse, migliorando la qualità complessiva del processo.

Resta però centrale il contributo umano, non solo per validare gli output tecnici, ma soprattutto per cogliere segnali sottili, leggere tra le righe e dare alle informazioni il giusto peso strategico. È proprio l’integrazione tra efficienza, competenze, intuito ed esperienza a generare valore aggiunto.

A cura di:

Marco Zorzetto

Sebastian Birolini

The role of the Chief Financial Officer (CFO) is undergoing a significant transformation in response to rapid technological advancements, particularly with the rise of artificial intelligence (AI) and hyper-automation. Traditionally, CFOs were primarily responsible for overseeing traditional financial operations, but today, they have become strategic partners in driving innovation and digital transformation across organizations. This shift is enabling CFOs to not only manage finances but also contribute to shaping the future direction of their businesses, in alignment with digital strategies.

The Impact of Automation on the Traditional CFO Responsibilities

The growing integration of automation technologies, such as AI, Robotic Process Automation (RPA), and Enterprise Resource Planning (ERP) systems, has relieved CFOs from many routine tasks, such as accounting reconciliation and invoice processing. As automation takes over these repetitive activities, CFOs are now able to focus more on strategic planning, risk management, and business transformation, ensuring that technology investments align with long-term organizational goals. Today, the large majority of CFOs are now actively involved in defining their companies’ digital strategies, recognizing the critical role that technology plays in driving both efficiency and profitability.

Bridging the Gap: CFOs and CTOs as Collaborative Partners

The growing importance of technology in driving business outcomes is reshaping the relationship between the CFO and Chief Technology Officer (CTO). Historically, these roles were siloed, with CFOs handling financial management and CTOs focusing on technology infrastructure. However, the rise of digital technologies and innovation has blurred these lines. CTOs have expressed an interest in adopting flexible IT delivery models, such as Agile software development and DevOps, to accelerate innovation. Yet, this transition is often impeded by traditional finance processes that are not designed to accommodate the speed and flexibility required by modern technology development.

The tension between IT and finance processes can impede progress, particularly when it comes to funding strategic innovation. Traditionally, finance teams have adhered to rigid budgetary cycles and project-based funding models, which may not align with the iterative and agile nature of modern technological initiatives. To overcome these barriers, it is critical for CFOs and CTOs to work together to evolve financial planning and budgeting methods that can better support agile technology development. This is where the collaboration between CFOs and CTOs becomes particularly valuable.

Flexibility in Finance: Adapting to Agile Innovation

In an era where agile methodologies dominate technology development, it is crucial for finance teams to adapt their budgeting and reporting processes to align with the dynamic nature of innovation. Deloitte’s survey (CIO Survey) highlights that only 18% of IT budgets are allocated to building new business, while the remaining 56% is spent on maintaining existing operations. This traditional allocation can hinder innovation efforts. Agile initiatives, which prioritize flexibility and speed, require a shift in how funds are allocated and tracked. Instead of sticking to rigid, long-term budget estimates, finance leaders need to adopt more flexible funding models that are outcome-based and allow for iterative funding of technological innovations as they evolve.

To this end, CFOs and CTOs must engage in continuous dialogue to align their priorities. Companies like Barclays have successfully shifted to more agile finance models, with teams meeting quarterly to reassess their technology roadmaps and funding priorities. This iterative approach allows organizations to respond more quickly to changing market conditions, regulatory shifts, or emerging technologies. The move from traditional, time-bound projects to long-term, capacity-based funding is an essential step in supporting continuous innovation.

The Role of AI and Technology in Business Transformation

Technologies like AI and machine learning are not only reshaping how businesses operate but also how they make financial decisions. AI-driven predictive analytics enable CFOs to make better forecasts, optimize spending, and identify growth opportunities that were previously difficult to anticipate. This ability to leverage data for informed decision-making has become a cornerstone of modern financial leadership, helping CFOs take a more proactive, strategic role in driving the company’s growth.

Moreover, AI facilitates automation and streamlines processes that were once time-consuming, such as inventory management, supply chain optimization, and customer relationship management. These efficiencies not only improve operational performance but also contribute to enhanced profitability and the ability to reinvest in innovative initiatives.

Conclusion: A New Paradigm for Business Success

The evolving role of the CFO is not simply about adopting new technologies but about integrating these innovations into the core strategic decision-making processes of the business. CFOs must evolve from being number-crunchers to being key drivers of digital transformation, working closely with CTOs to ensure that technology investments align with broader organizational goals.

The future of the CFO-CTO collaboration is one where flexibility, agility, and data-driven decision-making are paramount. As businesses navigate the challenges of digital transformation, the partnership between the CFO and CTO will be critical to ensuring that technology investments not only optimize costs but also accelerate innovation and long-term profitability. This evolving dynamic between finance and technology is the foundation of a new leadership model, one that is agile, collaborative, and ready to meet the challenges of a rapidly changing business environment.

Edited by:

Giordano Cogliati

Mattia Cattaneo di Unibg

The COVID-19 pandemic has resulted in the largest and dramatic drop in economic activity in modern history. Among the many criticalities, one of the largest was the handling of human resources (HR). Human capital represents the most important part of firms’ knowledge stock and accounts for a significant percent of operating expenses (70% on average), which are traditionally characterized by a low degree of flexibility.

The labor market has changed rapidly from February 2020, changing the experience of work for thevast majority of employees and forcing organizations across the globe to adapt how work is organized and how jobs are designed. Globally, extraordinary HR initiatives have been implemented to face cost-cutting pressures. In common law countries (e.g., US), the large majority of organizations have started to lay off a large part of their workforce to cut costs, while in civil law countries, such as Italy, important governmental lay-off extraordinary measures have been implemented to support employees and ban the termination of collective and individual contract agreements during the pandemic period. In turn, this has created re-organizational issues, reducingcompanies’ autonomy and internal flexibility.

Nowadays, with restored confidence and the vaccine campaign, HR leaders are required to think through what will come next, and how to appropriately implement cost-effective workforce strategies to restore business growth as well as preserve the employees’ welfare.

The cost of re-hiring competence. Once the economy will re-start, organizations will have to consider rehiring or replacing workers. Employers often underestimate the costs to replace employees. These costs are instead notable – estimated to account for about one-third of a worker’s annual earnings and increasing with the level of education (The Center for American Progress) – and spans from more explicit costs incurred for the opening of a new position and the training of a new worker to more hidden (and potentially way more relevant) costs associated with the loss of social capital and creativity due to workers’ departure. From a cost perspective, organizations need to urgently and strategically balance the need for re-hiring competence with HRcost-cutting decisions, while preserving employees’ engagement and productivity. An in-depth evaluation of their contribution within the corporate ecosystem can help avoid rash decisions that might damage key talent outcomes in the middle-long term.

The cost of smart working in the post-COVID era. During the first waves of the pandemic, COVID-19 forced many firms to leave employees at home. Today, with raising vaccination campaigns, return to offices and in-person interactions appear closer. However, as reported by interviewed members of the Harvard Business School, the new post-COVID workplace will strongly differ from the past and workers’ productivity should be fostered within a new paradigm. As much as some employees will crave the return of in-person social connections in the office, they have become accustomed to the flexibility that comes with virtual work, from less time to commute to more time with family. Managers will have to accommodate changes to work patterns and find newsolutions not to incur in costs associated with a low level of personnel’s commitment, knowledge transfer, creativity, and problem-solving capabilities. From a cost perspective, a better understanding of how new forms of remote working could both preserve employees’ productivity and allow the re-organization of firms’ physical spaces (and associated expenses) is today essentialfor sustainably operate in the “new normal”.

Human resource management in the new era. Human resource leaders have become central to the response in organizations globally in the last two years. At its core, the COVID‐19 pandemic has been indeed a human crisis that implies profound socio-psychological, physical, and technical implications for employees. This contrasts with previous crises such as the global recession of 2008-09 or the Y2K crisis that focused on only financial or IT aspects. Today, the increasing importance to constantly examine workforce planning and their conditions, along with emerging skills and digitalization trends will make HR leaders key figures in the organization. HR leaders will need to adapt and be equipped to appropriately evaluate the trade-off between home working and in-person working and thus implement new extended work-from-home engagement activities, implement virtual performance evaluation for new candidates as well as train employees to work effectively and efficiently remotely.

More than a necessity, being successful in the redesign of the future of work will constitute a key factor of talent acquisition and retention strategies, eventually boosting company’s competitive advantage.

Edited by:

Daniele Piazzalunga

Mattia Cattaneo (Università degli Studi di Bergamo)

In the early months of 2020, the outbreak of COVID-19 pandemic has dramatically affected the global economy, forcing companies to quickly adapt for a new business landscape. The impact on M&A volume diverged substantially across industries and economic areas. Global M&A activity was strongest in sectors least impacted by COVID-19 (e.g., tech, healthcare, and financial services), while it suffered a severe setback in industries more affected by the pandemic and characterized by medium/long-term recovery paths (e.g., energy/utilities, real estate).

Quite surprisingly, despite the brutal halt in the first months of 2020 (with monthly activity much lower than that registered in prior years), the global M&A market did not just recover but went into overdrive by the end of the year, reporting an average monthly count far beyond the historical norm in the second half of 2020 (e.g., about 13% higher than 2019. Source: Morgan Stanley). Furthermore, market insights reveal that M&A opportunities in the coming years will abound for companies who kept a strong position through the pandemic and that are in the right place to take advantage of them, whether these open up new markets or allow for bargain acquisitions.

QuotingRob Kindler, Global Head of M&A at Morgan Stanley: “All the elements are there for an active M&A market in 2021, from corporations looking for scale and growth to private equity firms and SPACs looking to invest capital”. Specifically, several are the factors underpinning a robust M&A activity in 2021, such as the expected rebound in sectors that were more severely affected by COVID-19, abundant capital from private equity and special purpose acquisition companies (SPACs), and the increasing emphasis toward digital transformation.

At the same time, companies must be ready to capitalize on these elements and take advantage of M&A deals. Recent reports by Deloitte and KPMG highlight some fundamental concepts that will be essential for companies to strengthen their positions for survival and success in the “new normal”, as well as to successfully handle future transactions and sustain corporate growth.

Resilience appears to be the new paradigm in setting up a successful post-covid M&A strategy. The pandemic has highlighted the importance of building and maintaining resilience in every aspect of the business, not only from a financial perspective, but also from the perspective of human resources, operations, and IT integration. From a deal perspective, building resilience entails a greater strategic emphasis on a company’s business portfolio and deal evaluation practices such as M&A planning and due diligence. Having a good understanding of the commercial aspects of a business target and ensuring that it is aligned with the refocused business strategy is of paramount importance to be resilient in today’s uncertain and fast-changing environment. In turn, this calls for a more integrated and strategic assessment as part of any pre-deal discussion, with a focus on identifying risks and opportunities associated with the new business landscape. Despite increased uncertainties and changing business models, COVID-19 has accelerated some broader shifts in the deal market and the economy in general, which should also be taken into account when planning for M&A. These involve, for instance, new working paradigms and organizational changes, which mandate companies to think through how the future of work will impact their business and transactions’ synergies.

Digital transformation and sustainability will be key drivers of investment and deal activity. A key component of a business’ arsenal in becoming and staying resilient is the investment in innovation. In the near future, governments are going to invest greatly in new technology and infrastructure to create an economic stimulus, while pursuing a strategic shift towards sustainability. A notable example is Europe’s investment in the electric vehicle infrastructure and green deal, or the Recovery Plan itself, which will be centered around the achievement of digitalization and sustainability targets. In this respect, M&A has an important role to play as companies typically pursue innovation either internally through R&D activities or by acquiring innovative targets. Hence, a growth of M&A deals involving high-tech companies is expected. Furthermore, businesses that do not want to be left behind need to think about how they can innovate their products and operations, looking at M&A as a promising means to accelerate growth, gain scale and become more digitally capable.

Edited by:

Fabio Trabucchi

Sebastian Birolini (Università degli Studi di Bergamo)