TURNAROUND &

RESTRUCTURING

At your side for crisis management.

Due to a variety of factors, both exogenous and/or endogenous, companies may find themselves in situations that are attributable, to varying degrees, to business crisis.

Especially in recent decades, rapid macroeconomic changes at a global level have forced companies to change pace in order to avoid suffering the consequences of a more competitive market.

“Turnaround” is generally characterised by declining or even negative margins, while “Restructuring” deals with more critical situations where financial strains and liquidity crisis have already been reached, up to insolvency and recourse to bankruptcy proceedings. In general, we can say that these are situations in which the company, without suitable intervention, risks jeopardizing the continuity of its business.

In the event of a crisis, it is imperative for a company to take prompt action.

In order to do so, it is advisable to know the stages and signs.

Our method

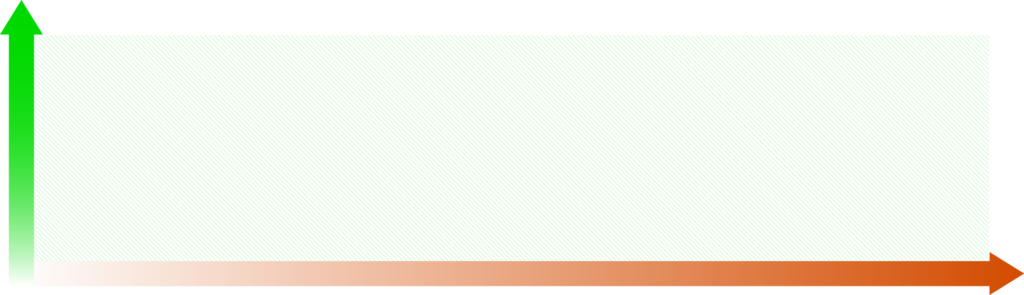

INDIRECT:

Advisory

DIRECT:

Interim management

3XCapital involvement

TURNAROUND

RESTRUCTURING

Progress of crisis

Daily management support

Cash flow/Liquidity

management

1 STRATEGIC CRISIS

In the first stage, the company is no longer able to compete effectively. Sales may have remained the same, but margins have begun to decline.

2 PROFITABILITY CRISIS

If the company does not take defensive action, the crisis turns into the second stage which means economic crisis: sales are stable or falling, margins are decreasing and even becoming negative. At this point, the company begins to burn through its cash reserves and needs to start a turnaround activity.

3 LIQUIDITY CRISIS

If the turnaround is not effective or quick enough, and the company continues to burn cash, it enters the liquidity crisis stage. At this point, the company may find itself without sufficient financial resources to continue operating. Typically, there is also a lack of trust in the company from stakeholders (customers, suppliers, banks), who can even take legal action to recover their credits. Hence, restructuring is necessary, and in the worst cases, recourse to bankruptcy proceedings.

BANKRUPTCY PROCEEDINGS

Bankruptcy proceedings are interventions aimed at providing solutions to the state of crisis of a company…

CHIEF RESTRUCTURING OFFICER

Also known as a “crisis manager”, the Chief Restructuring Officer (CRO) is a manager with experience in both the day-to-day management of the business…